Project Scope

The 2018 dramatic rise in Atlanta’s property tax assessments alerted many to the possibility that property taxes could threaten long-term homeowners with displacement. Atlanta BeltLine, Inc., in an effort to examine and mitigate the risk of displacement from rising property taxes, contracted APD Urban Planning & Management to explore the possible strategies that would reduce the property tax burden on vulnerable homeowners within the Atlanta BeltLine planning area, including the possible implementation of a Community Stabilization Program.

Our Work

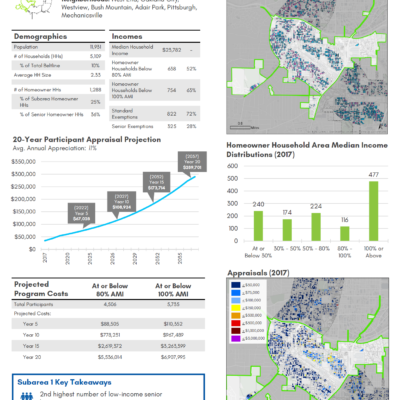

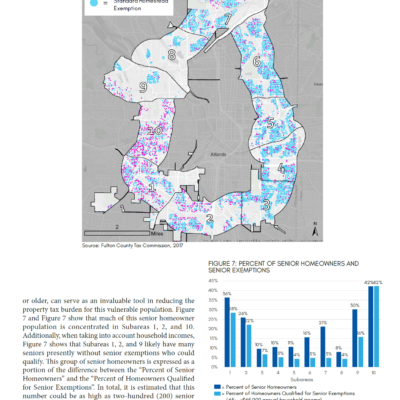

The study includes a variety of strategies that would reduce displacement pressure on vulnerable homeowners within all ten Atlanta Beltline subareas. Strategies were built for the diverse geographies that each subarea represents. The possible implementation of a Community Stabilization Program that would limit future property tax increases for area homeowners was explored, with three potential program models tested using homeowner population, income, age, length of occupancy, historic neighborhood valuations, and assessment data. Property value growth projections were used to demonstrate the estimated growth of the potential program cost over a twenty-year lifespan.

Deliverables

- Comprehensive existing conditions analysis

- Existing and future tax burdens and the risk to homeowners of rapid property appreciation

- Recommendations for effective policies to target homeowner populations most in need of displacement mitigation

- Program eligibility design

- Supplemental or supportive policies or tools to complement the program

- 10 Subarea condition summary studies